Credit Cards That Cover Rental Car Insurance

These cards can save on rental car insurance, especially for international travel.

Disclaimer

This article covers only some of our picks for the best credit cards for rental car insurance. All information about the American Express® Green Card has been collected independently by Kiplinger. We may get compensation if you visit partner links on our site. We may not cover every available offer. Our relationship with advertisers may impact how an offer is presented on our website. However, our selection of products is made independently of our relationship to advertisers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Rates checked as of July 2, 2024.

Should you tick the box for rental car insurance at the Avis, Budget or other rental car counter? Or does your personal auto insurance or rewards credit card already offer this benefit? Given that supplemental insurance for rental cars can cost around $13 to $30 per day or more, it's worth asking these questions first.

Figuring out card benefits before you travel is smart. However, wading through the perks offered by multiple rewards credit cards can be arduous and confusing. A recently updated study from WalletHub did the heavy lifting for you, comparing the travel benefits of 86 credit cards from the ten largest issuers.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

But before you compare travel credit cards for rental insurance perks, consider that you might not even need this insurance.

Do you need rental car insurance?

If you live in the U.S. and own a car for personal use, you likely don't need additional insurance when you rent a car in the U.S. That's because your own auto insurance policy will cover your rental car. But some U.S. states, like Florida and New Hampshire, only require more limited coverage for auto insurance. If your personal auto policy lacks collision and comprehensive insurance, your rental car could be underinsured in an accident or mishap.

Some of the better travel credit cards for travel also have rental car coverage in many international locations. But there are exceptions.

Either way, you should call both your credit card and your auto insurer before you rent a car, as your policy may have changed. And make sure you understand the different types of auto insurance.

Here is a summary of what personal auto insurance and the highest-rated travel credit cards may cover when you rent a car:

| Rental Car Insurance Scenarios | Personal Auto Insurance | The Best Travel Credit Cards |

| Travel in the U.S. | Yes | Yes |

| International Travel | No (except Canada) | Yes (though most cards exclude Italy, Ireland, Northern Ireland, Australia, Israel, Jamaica and New Zealand) |

| Business Travel* | No | Yes, with some exceptions |

| Luxury car rental | You may need additional insurance | Yes |

| Exotic cars, off-road, trucks | No | No |

*Government employees, such as military and postal workers, may have auto insurance coverage as an employment benefit. If you work for a private employer, check if you are covered under a company policy.

So, even if you have a personal auto insurance policy, it makes sense to get one of the best travel cards to cover a rental car in the following instances:

- Lower value. The car or cars you have insured are worth much less than the car you intend to rent. Since most rental cars are fairly new, this is a common scenario.

- International driving. You plan to rent a car outside of the U.S. or Canada.

- Business travel. You plan to rent a car in the U.S. or abroad while traveling for business. The auto insurance on your personal vehicle does not extend coverage to a car rented for business travel.

- Weak personal auto insurance. Your personal auto insurance policy offers much less protection than a good travel credit card.

- Keep your premium low. You want to avoid your personal car's auto insurance premium rising in the event of an at-fault accident, an option if your credit card offers primary insurance.

Hot Tip: Don't wait until you get to the car rental counter to set up insurance based on your credit card, especially for international rentals. You may be told that some insurance is required by national law (hello, Italy) and that the car cannot be rented without some form of domestic insurance. Clear up any of these issues ahead of time.

Comparing credit card issuers

Many financial institutions, like Bank of America or U.S. Bank, offer auto rental benefits. And perks will vary from card-to-card, so it's important to understand the terms of each card.

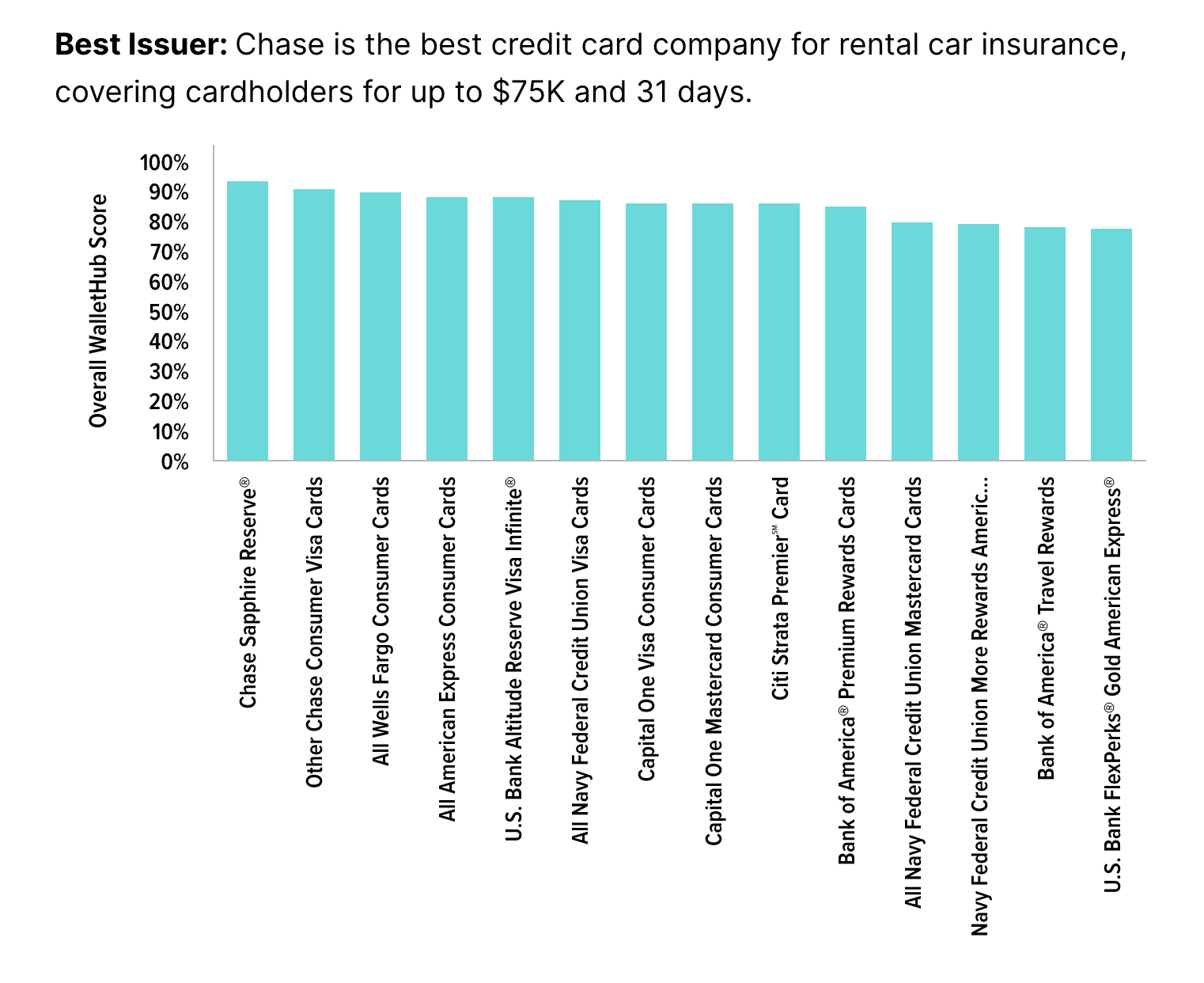

Chase Bank offered the best rental car insurance benefits among the personal credit card issuers studied by WalletHub. Check out the chart below to see how your card compares.

No coverage: Synchrony and Discover do not offer any car rental coverage on any of their credit cards.

Best coverage from Chase and Wells Fargo

First and Second Place — Chase Cards: Chase credit cards offer the best car rental insurance compared to other issuers. Chase will insure rentals globally, including in countries like Italy and Ireland that other cards may prohibit. Chase also boasts the highest per-vehicle coverage amount (up to $75,000), and coverage extends up to 31 days, whereas most competitors will insure only up to 15 days in your home country.

Finally, Chase cards cover damage that occurs when driving on a dirt or gravel road, and damage to tires and rims.

The top-scoring personal credit card is the Chase Sapphire Reserve® Card.

All other Chase consumer cards scored second for car rental benefits. For example, the Chase Sapphire Preferred® Card has a lower annual fee than the Sapphire Reserve card but still offers solid travel benefits. For details, read our review of the Chase Sapphire Preferred bonus offer.

Third Place — Wells Fargo. The 2024 study found that Wells Fargo cards slightly edged out last year's third-place winner, American Express.

Most Wells Fargo credit cards offer rental car insurance, including popular cards like the Wells Fargo Active Cash®, Wells Fargo Autograph® and the BILT Mastercard®. Coverage is typically for up to 31 days outside of the US and 15 days within. Wells Fargo does not insure cars rented in Israel, Jamaica, the Republic of Ireland or Northern Ireland. Maximum coverage is up to $50,000.

Fourth Place — American Express. In addition to excellent coverage, American Express offers Premium Car Rental Protection** for a small fee per rental period, not per day. Unlike many other plans, this benefit extends to SUVs and luxury cars.

There's a fabulous business card sign-up deal if you're in the market for American Express cards. Read more in our article, $1,500 to $3,000 Amex Card Intro Offer. For a personal Amex card, check out our article on three Delta and American Express cobranded cards: Earn Delta SkyMiles up to $1,140. Or consider The Platinum Card from American Express, currently offering new cardholders a $1,600 sign-up bonus.

First Place: Chase Sapphire Reserve®

This card is ideal for those willing to book travel, dining, and other services through Chase's rewards programs. Earn between 5 and 10 points for each dollar booked through Chase. Plus get a $300 yearly statement credit for travel purchases.

According to WalletHub, this card offers the best rental car insurance for coverage at home and abroad.

Earn 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening. That's $900 toward travel when you redeem through Chase Travel℠, more than offsetting the $550 annual fee.

This card provides the kind of travel perks you would expect from a high-end card, like access to VIP airport lounges, hotel room upgrades, and up to $100 every four years to help offset the cost of TSA PreCheck® or NEXUS applications.

- Interest rate: 22.49% to 29.49% variable.

- Annual fee: $550; $75 for each authorized user.

- Foreign transaction fee: None

- Rewards:

- Earn five total points on flights and ten total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually.

- Earn three points on other travel and dining and one point per $1 spent on all other purchases.

- Keep in mind that you get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- Other benefits: An annual statement credit of up to $300 for travel purchases (purchases that qualify for the credit do not earn points until the $300 travel credit has been applied), a Priority Pass Select membership for airport lounge access, perks at properties in the Luxury Hotel & Resort Collection and 10 points per dollar on Lyft rides through March 2025.

- Lounges: Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select. For example, you can relax at the Chase Sapphire Lounge at the NY LaGuardia Airport.

- When things go wrong: Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Redemption: Points are transferable to partner airline and hotel loyalty programs, or trade points at a healthy rate of 1.5 cents each when you redeem them for travel bookings through Chase Travel℠, or for statement credits against purchases in rotating categories through Chase's Pay Yourself Back program (including Airbnb, dining, charitable donations, and other categories).

- Sign-up bonus: 60,000 points if you spend $4,000 in the first three months, for a total value of $900 toward travel when you redeem through Chase Travel℠.

- Member FDIC

Second Place: Other Chase personal credit cards like the Chase Sapphire Preferred® Card

The Chase Ultimate Rewards® points that you earn with this card are redeemable for travel bookings through Chase Travel℠ at a heightened value of 1.25 cents each, or get a respectable value of 1 cent per point for cash back or gift cards. Alternatively, transfer points to a solid list of partner travel loyalty programs, including Southwest Airlines Rapid Rewards, United MileagePlus, Marriott Bonvoy and World of Hyatt.

Earn 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening. That's about $750 when you redeem through Chase Travel℠. For our review of this bonus offer, read Chase Sapphire Preferred Credit Card: $750 Bonus Offer.

- Sign-up bonus: 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening; that's $750 when redeemed for travel through Chase Travel℠.

- Rewards:

- Five points per dollar on travel purchased through Chase Travel℠ and two points per dollar on other travel spending;

- three points per dollar on dining, select streaming services and online groceries; and

- one point per dollar on other spending.

- Other benefits: $50 annual Hotel Credit. Get $50 in statement credits annually for hotel stays booked through Chase Travel℠. And on each yearly anniversary of opening your account, you get a 10% points bonus on total purchases made the previous year.

- Redemption: Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel. You can transfer Chase points to a partner like British Airways at a one-to-one ratio, where one Chase point is equal to one British Airways frequent flyer point. But if you book your trip through the Chase travel portal, your points are worth 1.25 miles on British Airway's frequent flier program. This 25% boost does not expire, but is built in the Ultimate Rewards program.

- Interest rate: 21.49% to 28.49% variable APR for purchases and balance transfers, and 29.99% variable APR on cash advances.

- Annual fee: $95

- Foreign transaction fee: None, so this is an excellent card for international travel.

- Member FDIC

Third Place: Most Wells Fargo cards, such as the

Sign-up bonus: $200 back if you spend $500 in the first three months.

This card keeps it simple: Cardholders get 2% cash back on everything they buy. Redemption options include statement credits on purchases, a credit to other qualifying Wells Fargo accounts (including a checking account or mortgage) and gift cards.

- Sign-up bonus: $200 back if you spend $500 in the first three months.

- Rewards rate: 2% cash rewards on purchases.

- Redemption: Statement credit, cash at the ATM with a Wells Fargo debit or ATM card (in $20 increments), gift cards ($25 increments), or a credit to a qualifying Wells Fargo credit card, checking account or mortgage.

- Other benefits: Up to $600 per claim of protection for your cell phone against damage or theft if you pay your monthly wireless bill with the card.

- Interest rate: 0% intro APR for 15 months from account opening on purchases and qualifying balance transfers, then 20.24%, 25.24% or 29.99% variable APR.

- Foreign transaction fee: 3%, so skip this card if you are planning significant travel outside the U.S.

- Annual fee: None.

How to use your card for rental car insurance

Using your card's travel benefits, rather than the rental company's insurance, is simple. Once you have obtained or decided to use a card with solid rental car insurance, use that card to reserve a rental car. Then decline the theft and damage insurance offered by the rental company, and be sure to pay for the car rental with the same credit card.

Avoid rental car fees

Don't just save money by using the right credit card for rental car insurance, watch out for rental car fees that could undo all of your savings. For example, price out the cost of taking an Uber, Lyft or public transportation to the airport and return your car in town to avoid airport-return fees. You can also avoid high refueling fees by dropping the car off with a full tank of gas. Avoid daily toll transponder fees by bringing your own transponder on your trip. These are just some of the rental car fees to avoid.

**Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by Amex Assurance Company.

Related Content

- Eight Ways Seniors Can Save on Car Insurance

- Car Insurance Costs Skyrocket in 2024: Here's How to Save

- Credit Card Bonuses up to $1,600 for New Cardholders

- Get $1K off a Chevy Silverado with the Costco Auto Program

- The Most Common Types of Auto Insurance

Disclaimer

As an independent publication dedicated to helping you make the most of your money, the article above is our view of the best deals and is not the opinion of any entity mentioned such as a card issuer, hotel, airline etc. Similarly, the content has not been reviewed or endorsed by any of those entities.

Get Kiplinger Today newsletter — free

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ellen writes and edits personal finance stories, especially on credit cards and related products. She also covers the nexus between sustainability and personal finance. She was a manager and sustainability analyst at Calvert Investments for 15 years, focusing on climate change and consumer staples. She served on the sustainability councils of several Fortune 500 companies and led corporate engagements. Before joining Calvert, Ellen was a program officer for Winrock International, managing loans to alternative energy projects in Latin America. She earned a master’s from the U.C. Berkeley in international relations and Latin America.

-

Beryl Portends a Harsh Hurricane Season: Are You Ready?

Beryl Portends a Harsh Hurricane Season: Are You Ready?Hurricane Beryl is breaking records as the first hurricane of the season. Do you have the insurance you need?

By Erin Bendig Published

-

Stock Market Today: Markets Set Fresh Highs as CPI, Earnings Loom

Stock Market Today: Markets Set Fresh Highs as CPI, Earnings LoomStocks wavered on light volume ahead of a busy week for economic news and corporate earnings.

By Dan Burrows Published