Best Bond ETFs To Buy Now

Long-term investors should consider these bond ETFs to balance their portfolios.

The best bond ETFs have had a rough few years, that's for sure.

A rising interest-rate environment in 2022 and 2023 caused no shortage of disruptions to the typical investor's portfolio. And uncertainty surrounding the Fed's plans for rates moving forward has certainly sparked some short-term price swings in the bond market.

There is an inverse relationship between bond funds and yields, because older (and lower-yield) bonds become less attractive as interest rates rise – and are discounted as a result. This fact caused many major funds to slip in recent years. The good news, however, is that many bond ETFs are starting to stabilize and now offer yields that are significantly higher than the stock market after the Fed's rate hikes.

And the simple fact is that bonds remain a key part of any portfolio. "We still think high-quality bonds play a pivotal role in portfolios as they have shown to be the best diversifier to equity risk," says Lawrence Gillum, fixed-income strategist at independent broker-dealer LPL Financial. "And it's best to have that portfolio protection in place before it's needed."

To be clear, most investors should never give up on stocks. Over the long term, equity investments are an effective path to growing your money and every diversified portfolio should look across different asset classes. But it has become increasingly apparent over the years that bonds are a very important asset to hold – and one that many investors may be lacking exposure in their holdings.

With that in mind, here are six of the best bond ETFs for investors who are looking beyond stocks or interested in boosting the income potential of their portfolio.

To continue reading this article

please register for free

This is different from signing in to your print subscription

Why am I seeing this? Find out more here

The best bond ETFs

Each of the funds featured here has something different to offer, boast cost-effective annual fee structures and generous yields of more than 3% based on the standard calculations of the U.S. Securities and Exchange Commission (SEC). They all boast cost-effective annual fee structures, as well. SEC yields reflect the interest earned after deducting fund expenses for the most recent 30-day period and are a standard measure for bond and preferred-stock funds.

| Exchange-traded fund/ticker | Assets under management | SEC yield | Expenses |

|---|---|---|---|

| Vanguard Total Bond Market ETF (BND) | $108.6 billion | 4.7% | 0.03% |

| iShares 20+ Year Treasury Bond ETF (TLT) | $50.2 billion | 4.5% | 0.15% |

| iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) | $29.5 billion | 5.4% | 0.14% |

| Vanguard Total International Bond ETF (BNDX) | $55.9 billion | 3.3% | 0.07% |

| Vanguard Short-Term Bond ETF (BSV) | $32.2 billion | 4.9% | 0.04% |

| iShares iBoxx $ High Yield Corporate Bond ETF (HYG) | $17.4 billion | 7.4% | 0.49% |

| Row 6 - Cell 0 | Row 6 - Cell 1 | Row 6 - Cell 2 | Row 6 - Cell 3 |

Vanguard Total Bond Market ETF

- Fund category: Intermediate core bond

- Assets under management: $108.6 billion

- SEC yield: 4.7%

- Expenses: 0.03%, or $3 annually for every $10,000 invested

The Vanguard Total Bond Market ETF (BND, $72.23) is the most popular of the Vanguard ETFs for bond investors, and one of the most popular bond ETFs of any stripe on Wall Street. It offers diversified exposure to the bond market in one simple and broad-based fund, with an enormous portfolio of more than 11,000 "investment grade" bonds.

That means debt securities of high credit quality from corporations or government entities that are at lower risk of default. Right now, about 50% of total assets are in government bonds, with another 27% or so in corporate debt and then the rest in "securitized" bonds that focus on pools of mortgage-related assets.

If you're a long-term, hands-off investor then you could do worse than BND. Buying into this one-stop holding gives exposure to the entirety of the domestic bond market without a lot of risk or complexity.

iShares 20+ Year Treasury Bond ETF

- Fund category: Long government

- Assets under management: $50.2 billion

- SEC yield: 4.5%

- Expenses: 0.15%

The iShares 20+ Year Treasury Bond ETF (TLT, $92.52) is one of the more focused bond ETFs. It is also one of the most popular vehicles out there to invest in bonds via one exchange-traded product.

As the name implies, this iShares fund only holds U.S. Treasury bonds with a duration of 20 years or longer. The downside is that this doesn't provide a ton of variety or diversification, but the good news is that U.S. Treasuries are one of the most stable assets in the world and viewed by many institutions as almost as safe as cash.

Just remember that the long "duration" of this fund's assets leaves it exposed to the inverse relationship between bond ETFs and interest rates however. This has caused TLT to slump about 30% in the last two years. If the Federal Reserve keeps rates higher for longer, this fund will likely see stiffer headwinds going forward.

iShares iBoxx $ Investment Grade Corporate Bond ETF

- Fund category: Corporate bond

- Assets under management: $29.5 billion

- SEC yield: 5.4%

- Expenses: 0.14%

The iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD, $107.86) takes a different approach than many of the other fixed-income funds featured here by carving out government bonds altogether. This allows investors seeking out the best bond ETFs to turn up the yield without taking on an inordinate amount of risk.

Specifically, LQD owns debt instruments solely from companies with strong credit ratings that are BBB or above. Think familiar names like Dow Jones stocks Goldman Sachs Group (GS) and JPMorgan Chase (JPM) or tech giant Oracle (ORCL) to name a few.

These are world-class organizations that aren't at risk of imminent failure or short-term disruptions by the latest headlines or fads. This means they are very likely to make good on their debts. But it's undeniably true that, when placed next to the U.S. Treasury, their operations are still riskier than the federal government. That risk premium results in a more generous yield that could be attractive to investors who aren't afraid of carving out government debt from their bond holdings.

Vanguard Total International Bond ETF

- Fund category: Global bond-USD hedged

- Assets under management: $55.9 billion

- SEC yield: 3.3%

- Expenses: 0.07%

The Vanguard Total International Bond ETF (BNDX, $48.64) is a sister fund to BND, offering an extra layer of long-term stability by taking a global approach. It's an "ex-U.S." fund, meaning it holds assets from everywhere in the world except the domestic bond market, allowing geographic diversification without overlapping other bond ETFs you might own.

More than 57% of BNDX's total assets are in Europe, with Asia-Pacific next in line at 20% or so. There's also about 7% in emerging-market debt, which adds both variety and the potential for a bit more performance.

Remember, you won't find bonds from U.S. blue chip stocks, the Treasury Department, or other issues that populate many of the best ETFs in this asset class. While this makes BNDX less than ideal as a core holding, the fund is undeniably popular because it allows for international exposure in a cost-effective way that's similar to the domestic BND fund.

Vanguard Short-Term Bond ETF

- Fund category: Short-term bond

- Assets under management: $32.2 billion

- SEC yield: 4.9%

- Expenses: 0.04%

The flip side of that long-dated bond fund from iShares is the Vanguard Short-Term Bond ETF (BSV, $76.56). This fixed-income ETF has an average effective maturity of less than three years, which is a fraction of TLT's average duration.

There's much less risk here on two fronts. For one, it's easier to predict economic trends a few dozen months down the road vs a few dozen years. Additionally, short-term bonds are less exposed to interest-rate volatility.

Interestingly enough, the higher rate environment we've been in for the past year or so has also boosted short-term yields, so you don't sacrifice income potential. This is evidenced in the Vanguard Short-Term Bond ETF's current 4.9% yield, which is nearly four times what you get from the S&P 500.

At present, BSV is split about 70%-30% between government bonds and investment-grade corporates, with the top holding being short-term U.S. Treasury bonds.

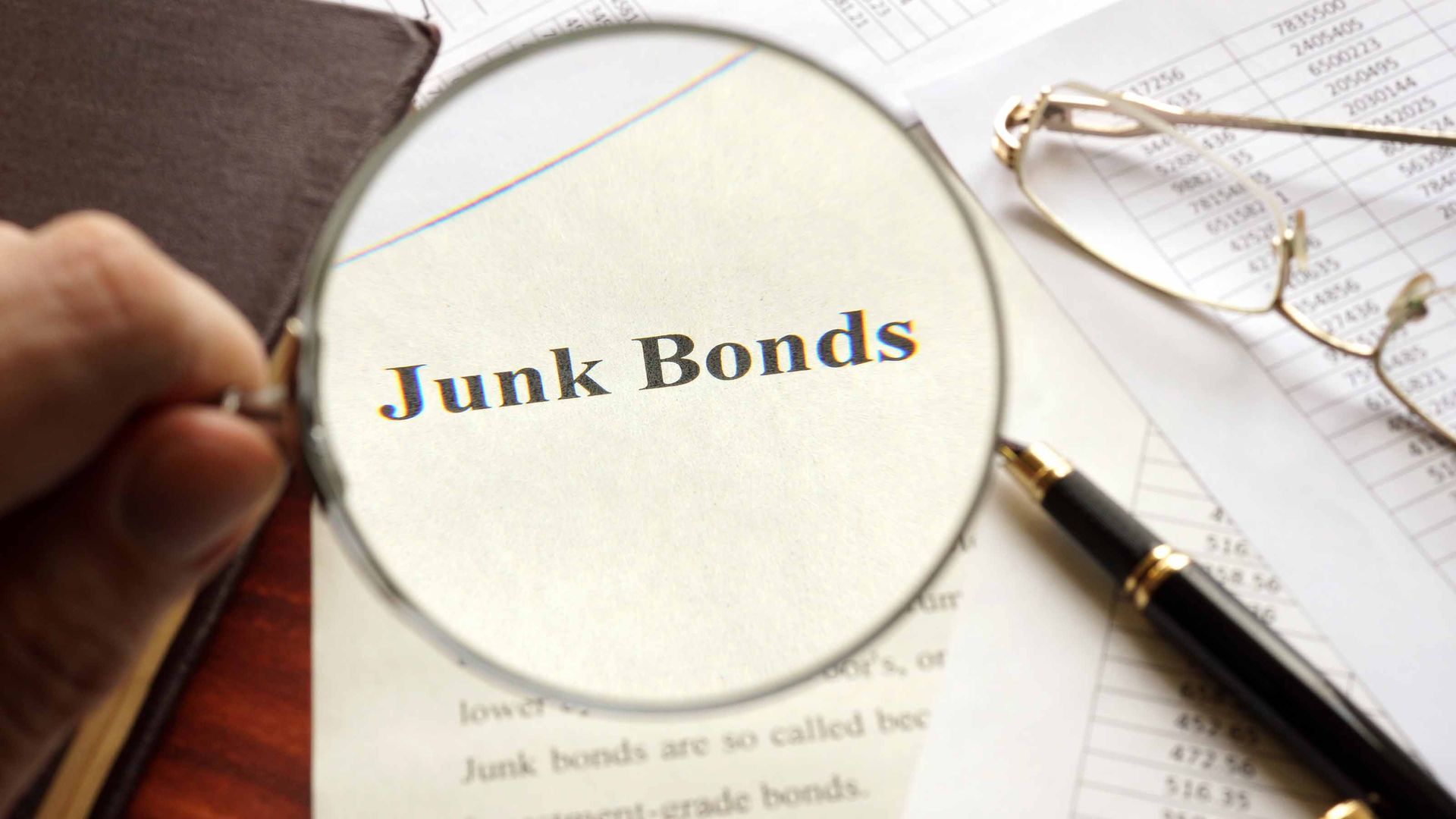

iShares iBoxx $ High Yield Corporate Bond ETF

- Fund category: High-yield bond

- Assets under management: $17.4 billion

- SEC yield: 7.4%

- Expenses: 0.49%

The iShares iBoxx $ High Yield Corporate Bond ETF (HYG, $77.37) is on the opposite end of the risk spectrum from the iShares iBoxx $ Investment Grade Corporate Bond ETF. This bond ETF focuses solely on high-yield or junk bonds from distressed borrowers.

We're talking companies like satellite radio company Sirius XM Holdings (SIRI) or hospital operator Tenet Healthcare (THC).

That higher risk profile does result in a higher yield though, with this fund offering roughly six times the yield of the S&P 500 right now. Just beware of what you're getting into with this more volatile bond ETF.

To its credit, while HYG is the "smallest" ETF on this list by assets and "most expensive" as measured by annual expenses, it's established and affordable.

Learn more about HYG at the iShares provider site.

Related content

Get Kiplinger Today newsletter — free

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jeff Reeves writes about equity markets and exchange-traded funds for Kiplinger. A veteran journalist with extensive capital markets experience, Jeff has written about Wall Street and investing since 2008. His work has appeared in numerous respected finance outlets, including CNBC, the Fox Business Network, the Wall Street Journal digital network, USA Today and CNN Money.

-

How AI Can Help a Lawyer Work Faster and Less Expensively

How AI Can Help a Lawyer Work Faster and Less ExpensivelyArtificial intelligence can quickly find a needle in a haystack of thousands of documents. It also remembers everything it’s read about the law.

By H. Dennis Beaver, Esq. Published

-

Beryl Portends a Harsh Hurricane Season: Are You Ready?

Beryl Portends a Harsh Hurricane Season: Are You Ready?Hurricane Beryl is breaking records as the first hurricane of the season. Do you have the insurance you need?

By Erin Bendig Published

-

Stock Market Today: Stocks Mixed After May CPI, Fed Meeting

The May CPI report came in better than expected, but the Fed still lowered its rate-cut expectations for the year.

By Karee Venema Published

-

Oracle Stock Soars on OpenAI, Google Deals, Strong Outlook

Oracle stock is trading higher as the software firm's new AI deals and upbeat outlook offset an earnings miss. Here's what you need to know.

By Joey Solitro Published

-

Stock Market Today: Stocks Fall After Hawkish Fed Minutes

Retail earnings were also in focus Wednesday with Target and TJX moving in opposite directions after their quarterly results.

By Karee Venema Published

-

Stock Market Today: Stocks Reverse Lower as Treasury Yields Spike

A good-news-is-bad-news retail sales report lowered rate-cut expectations and caused government bond yields to surge.

By Karee Venema Last updated

-

How Inflation, Deflation and Other 'Flations' Impact Your Stock Portfolio

There are five different types of "flations" that not only impact the economy, but also your investment returns. Here's how to adjust your portfolio for each one.

By Kim Clark Published

-

Kiplinger's Economic Calendar for This Week (July 8-12)

This week's economic calendar features a pair of key inflation updates and the latest reading on consumer sentiment.

By Karee Venema Last updated

-

Why I Still Won't Buy Gold: Glassman

One reason I won't buy gold is because while stocks rise briskly over time – not every month or year, but certainly every decade – gold does not.

By James K. Glassman Published

-

Should You Use a 25x4 Portfolio Allocation?

The 25x4 portfolio is supposed to be the new 60/40. Should you bite?

By Nellie S. Huang Published